Due Diligence completed in 4-6 weeks

Led India HR information gathering & focus group sessions

Risk analysis with potential mitigation plans

A lot of planning and preparation goes into making acquisitions and carve-outs work. Due diligence is an important part of the acquisition process and represents the orderly investigation of any matter pertaining to business dealings. In mergers and acquisitions, due diligence helps clients recognize any financial, legal, or operational risks that may not be noticeable from outside perspectives.

Business Challenge

- The client is a global provider of professional and tech-enabled services to simplify Electronic Health Record, provide documentation, revenue cycle and patient engagement complexities for health systems to enterprise customers worldwide Business Challenge.

- The client was acquiring a new Healthcare solutions business in US, ANZ & India.

- They asked Aeries to perform a due diligence evaluation of the target company’s Legal & Compliance, Financial statements, and India Payroll, Benefits, and HR policies and processes.

- The due diligence was followed by a gap analysis to help our client understand how best to align the acquired business with its global operations.

Aeries Solution

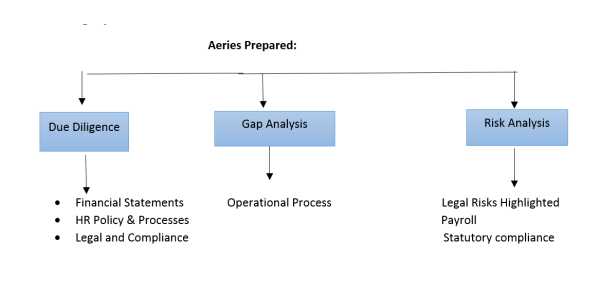

- Aeries understood the requirements of the client and assisted them in reviewing:

- Financial statements: Review of sales pipelines, customer loss analysis, and aided in other due diligence processes

- HR Policy & Processes: Detailed review of HR Policies, Payroll Registers, Payroll Compliances, Employee Data, Employment agreements, etc. to identify Gaps & Synergy opportunities.

- Legal and Compliance: The top 50 customers were analyzed. Customer contract, vendor contract and lease agreement reviews conducted.

- Aeries performed Gap analysis for operational process, provided feedback to the Leadership on cost impact, risks, observations as well as integration efforts requirement.

- Aeries led the India HR information gathering & focus group sessions with potential acquiree to clarify uncertainties and identify operational and statutory risks.

- Risk analysis for payroll and statutory compliances was performed, and cost estimates and potential mitigation action plans were provided by Aeries.

- Aeries also highlighted the legal risks based on contracts expired, missing contracts and non-renewals.

Business Impact

- Over a period of 4-6 weeks, Aeries shared a detailed Due Diligence report with Client, which helped them make an informed decision on acquisition. The highlighted risks, financial liabilities and synergy opportunities helped client see what to expect.

- To help the different stakeholders from organizations involved exchange information smoothly, Aeries enabled a seamless co-ordination via a robust communication matrix.